eZaga NSFAS App, ezaga login, ezaga nsfas registration, ezaga nsfas app download, ezaga app login, ezaga mobile account. eZaga NSFAS App dedicated to improving lives through digital solutions. At eZaga, they design and deliver digital solutions to drive social change in low-income communities across Africa and other emerging markets.

They provide tools and services to enable people to transform their lives with the mobile technology they already own. Using mobile enables us to reach people quickly, facilitate meaningful engagement and measure social change.

ezaga nsfas App

The National Student Financial Aid Scheme (NSFAS) is introducing its new direct payment solution for student allowances, through the NSFAS MasterCard. All NSFAS funded students will be provided with a MasterCard and a bank account where monthly allowances will be disbursed directly, on a monthly basis. We’re proud to present you with your own NSFAS MasterCard in partnership with eZaga.

ezaga nsfas Money Transfer

- Send money cheaper and easier than old-school banks.

Easy to use

- Access your account on the eZaga App or USSD *134*7772#

ezaga nsfas Payments

- Pay all your bills via the eZaga app

ezaga nsfas Withdraw

- Withdraw cash using your NSFAS Mastercard at any ATM or retail store.

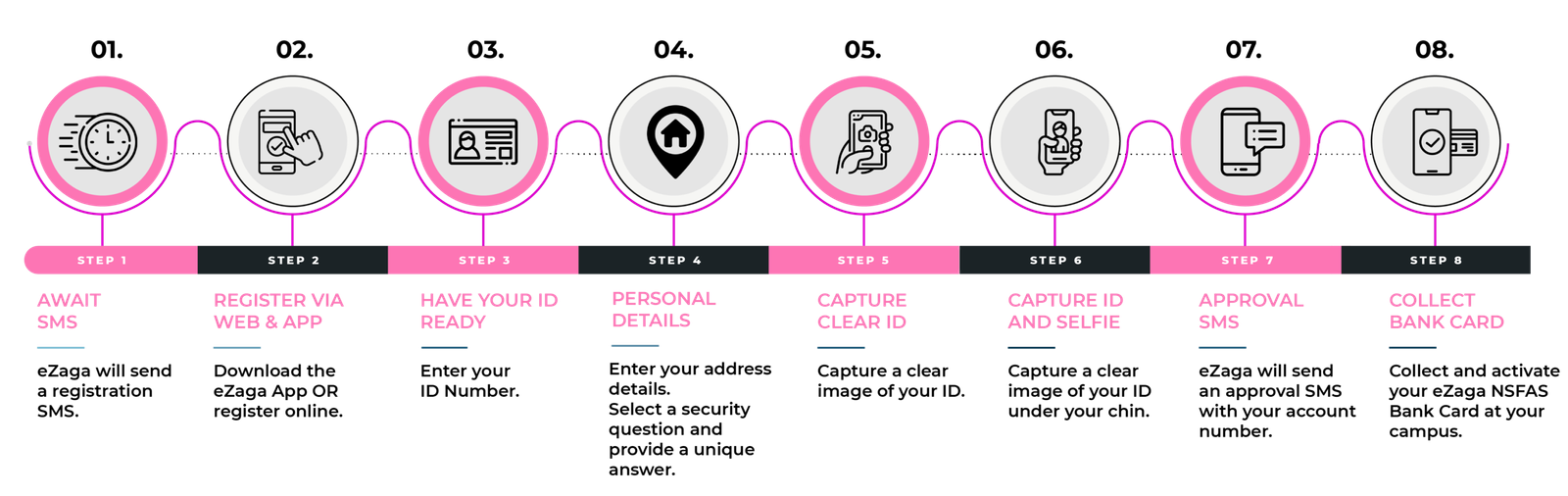

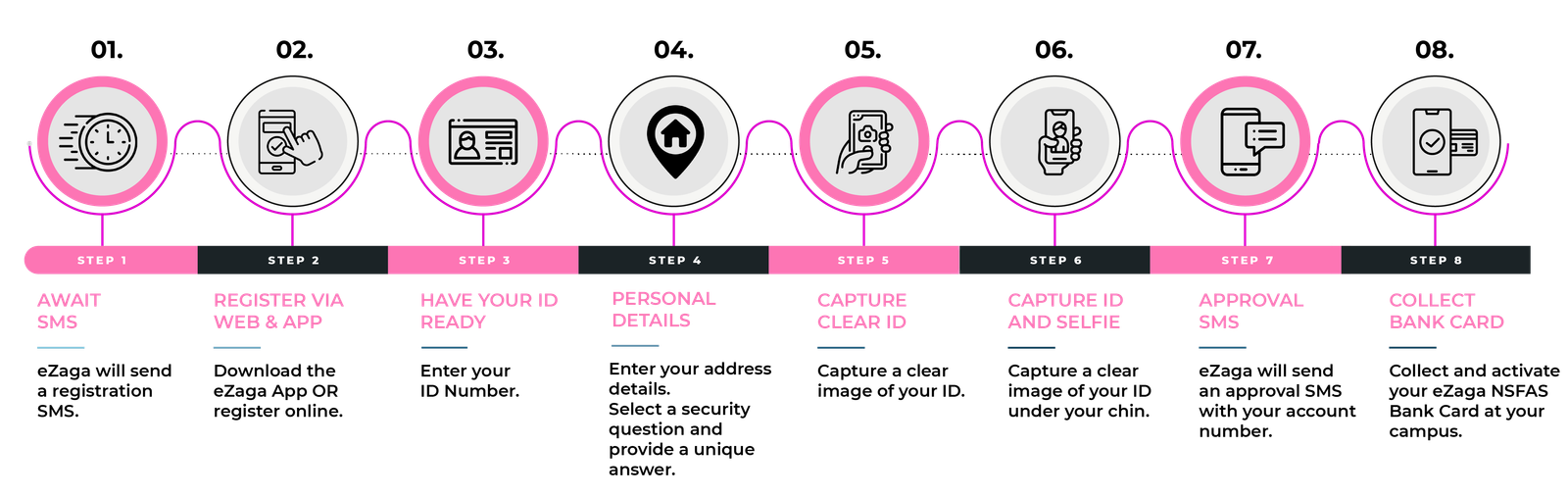

ezaga nsfas registration

Students will be required to register their eZaga NSFAS account in order to receive a bank card by doing the following:

- Visit eZaga’s website by clicking here or download the eZaga App

- Enter your ID number and temporary password “12345”

- Enter a One Time Pin (OTP) received via your email address.

- Capture your information

- Take a clear photo of yourself holding your ID and take a clear photo of your ID only.

- Wait for an approval SMS from eZaga.

- Once your account has been approved, a bank card will be distributed at your campus.

For more information visit official website link https://www.ezaga.co.za/nsfas-register/

eZaga NSFAS Using your Mobi Account

- You agree to the following:

- You can have only one Mobi Account with us.

- You will indicate how the Mobi Account is styled.

- You must use the Mobi Account in a manner acceptable to us.

- We will monitor the use of the Mobi Account for assessing compliance with and adherence to the Product Specifications.

- If you no longer qualify for the Mobi Account, we have the right to move you to an account that you do qualify for. We will tell you before we move you to another account. The terms and conditions and fees for that new account will then apply.

- We have the right to claim any difference in the fees applicable to the two accounts from you, from the date that you no longer qualify for the Mobi Account to the date of the move to the new account.

- Your Mobi Account (including the money in it) cannot be assigned to any other person.

- You authorise us to accept instruction by electronic means.

- To perform any transaction on your Mobi Account you will need your cellphone number and a PIN as set out below.

- You must keep your PIN secret and not disclose it to anyone.

- Mobi Account transactions will be authorised using your PIN and unless we receive notice from you not to, we will accept all authorised transactions, even if they are actually made without your authority.

- You can use your Mobi Account for the transactions listed in the menu.

- You may not use the Mobi Account for any unlawful or illegal transaction. It is your duty to make sure that a transaction is lawful.

- We reserve the right to reject a transaction in certain circumstances.

- We may debit the account with the amounts of all items you authorise, whether the account is in credit or otherwise.

- If a transaction cannot be completed, you will receive an error message explaining why.

- We will display the fee for each transaction with the transaction and will deduct it from your Mobi Account along with the transaction. We will send you your new balance after the transaction by SMS. .

- An account is transaction history available on the menu.

- You elect to receive electronic statements.

- At our sole discretion we may levy an additional cost against your Mobi Account for paper-based statements, through any self-service or digital channel.

- We will pay no interest if you have a positive balance in your Mobi Account.

- The information you give us about yourself must be accurate. You must notify us immediately if your details change.

- You must tell us immediately if your SIM or phone is lost, damaged or stolen.

- Use of an ATM, retailer platforms or other electronic device is at your own risk.

- If illegal money (counterfeit banknotes or any other purported banknotes not accepted as legal tender in South Africa) or defective notes (dye-stained or mutilated banknotes where the serial

- number is illegible or defaced) are deposited into the Mobi Account, we reserve the right to reverse any value given to you for such dye-stained notes.

- Your Mobi Account cannot be overdrawn.

Leave a Reply

View Comments