Two-pot system calculator South Africa, when will the two-pot system be implemented, two-pot system latest news, two-pot system tax, how to apply for two-pot system online withdrawal. The “two-pot” system was established by The Revenue Laws Amendment Bill (the Bill) Through this system, you will have access to a portion of your retirement savings without you needing to cash out or resign from the entire pension fund. The Bill that was signed into law by President Cyril Ramaphosa, changes the retirement-fund landscape and will take effect from 1 September 2024.

This webinar educated taxpayers about the implementation of this retirement reform, its savings-withdrawal benefit, and the implications for taxpayers’ retirement funds.

SARS’s strategic objectives are to give taxpayers clarity and certainty about their obligations, and to make it easy for them to comply.

Why is the government implementing the two-pot system?

So South Africans can retire more comfortably. Government wants us to become a nation of savers, but they understand that members of funds have emergencies as well. For this reason, you can access some of your retirement savings in an emergency without leaving your current employer.

The proposed date of implementation is 1 September 2024.

The Two Pot System marks a significant change to South Africa’s retirement landscape. It’s designed to provide you with a safety net in times of financial crisis while encouraging long-term savings.

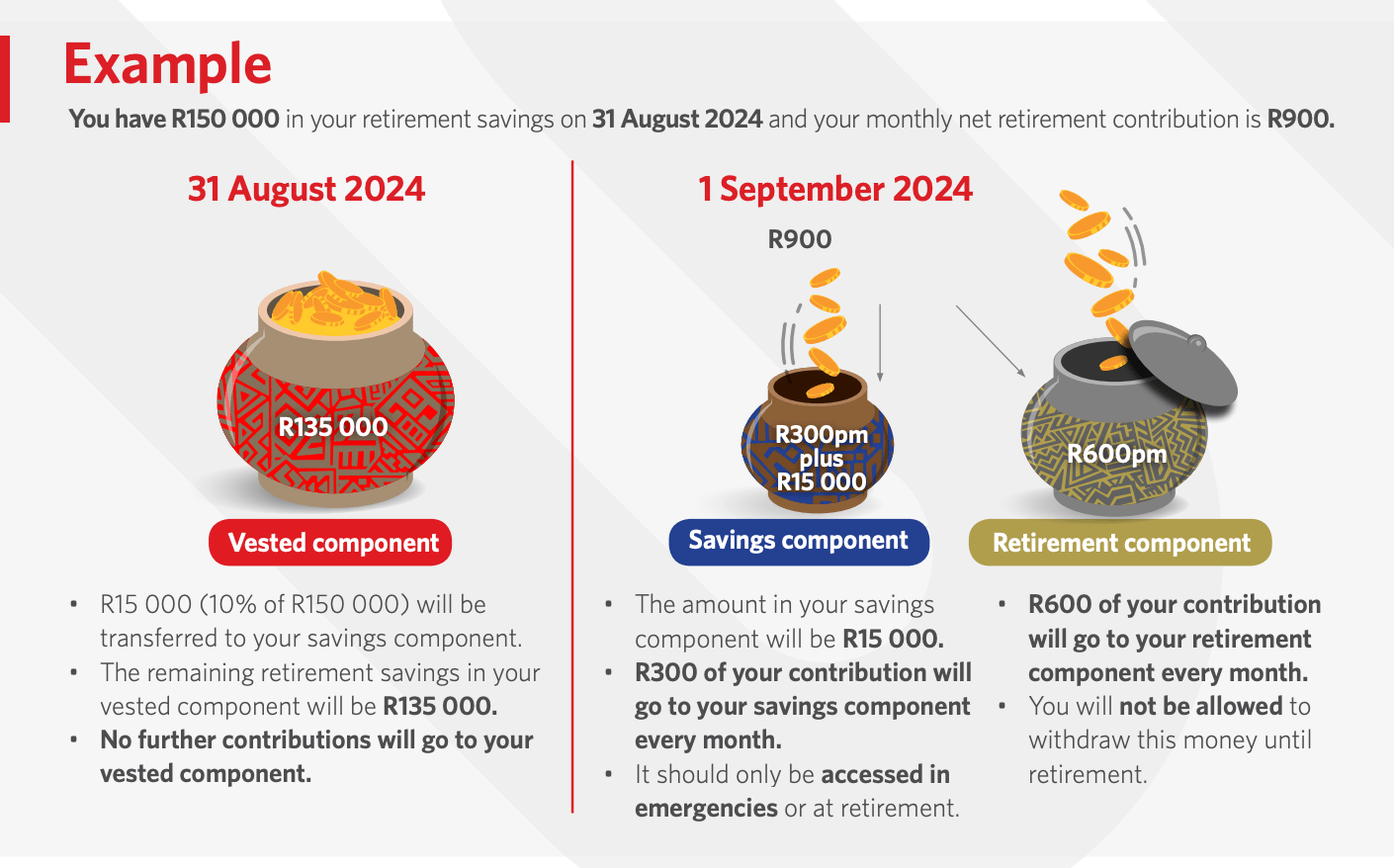

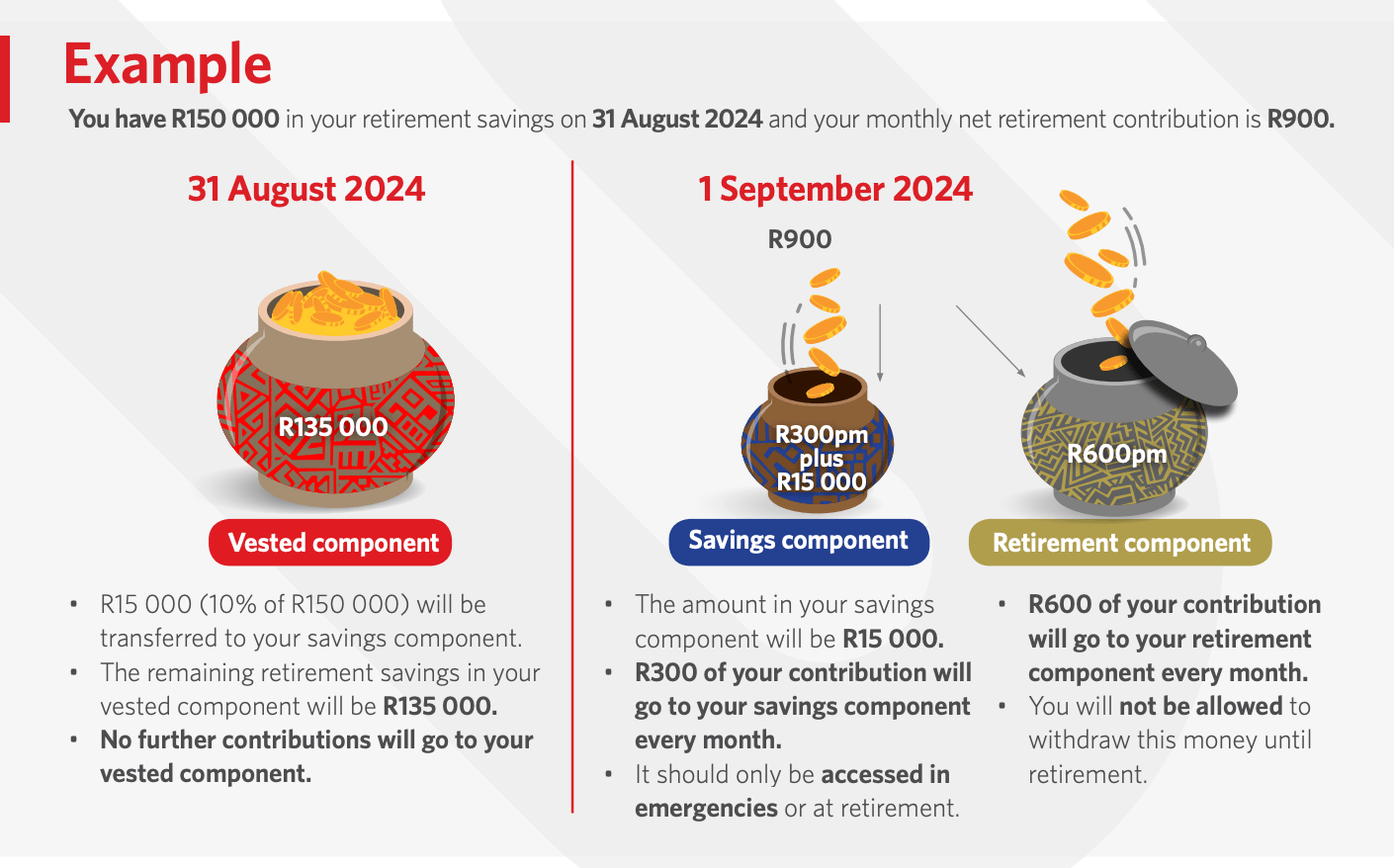

All your future contributions to your retirement fund will be split into two pots: a savings pot and a retirement pot. Your current retirement savings until 31 August 2024 will remain preserved in a vested pot.

How does the 2 Pot Retirement System affect

1.Vested component

- The money in your vested component will still follow the same rules.

- When you leave your employer you can: – stay as a paid-up member of the Fund. – take your money in cash. – transfer the money to another fund

2.Savings component

- You can withdraw this money when you retire.

- You can withdraw, for emergencies, a minimum of R2 000 (before fees and taxes) once a tax year without leaving your employer.

3.Retirement component

- You can’t withdraw any money when you leave your employer. This money must remain invested until your retirement.

- You must buy a pension when you retire.

Two-pot system calculator South Africa

Your retirement savings in your Fund will be divided into 3 components, a vested, savings and retirement component. Different rules apply to each component.

The calculator will assist pension fund members with an illustrative amount of what they can possibly expect as a payout. All relevant and accurate information must be provided to get a clear estimate of the payout. See the two-pot calculator here.

Two-pot system 2024 withdrawal – how to apply for two-pot system online withdrawal

Persons who intend to withdraw from the savings pot of the Two-Pot Retirement System from 1 September 2024 must be registered for tax. Those who are not registered must register before they apply to their relevant fund. If a person is not registered for tax, the request for a tax directive sent from the fund to SARS will be rejected.

Contributions to retirement funds are not taxed. Therefore, tax will be deducted from any amount withdrawn. Tax will be calculated at the tax rate applicable to the individual.

Taxpayers must also ensure that they have no outstanding returns and do not owe SARS. Debt owed to SARS will be deducted from the withdrawal amount.

Taxpayers are not required to go to a SARS office, as most applications are available on one of SARS’s digital or mobile channels.

Leave a Reply